inheritance tax on real estate nc

However there are 2 important exceptions to this rule. These are some of the taxes you may have to think about as an heir.

Explaining The Basis Of Inherited Real Estate What It Means For Your Kids

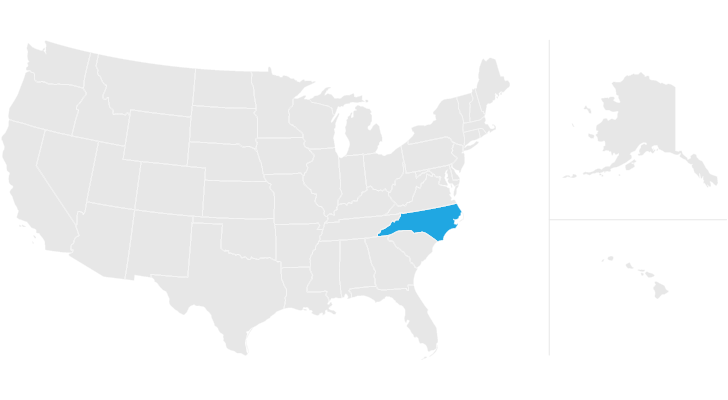

North Carolina Inheritance Tax and Gift Tax There is no inheritance tax in North Carolina.

. The inheritance tax of another state may come into play for those living in North Carolina who inherit money. You would pay 95000 10 in inheritance taxes. There is no inheritance tax in NC.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. North Carolina does not collect an inheritance tax or an estate tax. Does the IRS know when you inherit money.

State inheritance tax rates range from 1 up to 16. For example lets say the house you just inherited from your grandmother was originally purchased in 1960 for 25000. No Inheritance Tax in NC.

How Do You Sell A House When You Have A Mortgage. The inheritance tax of another state may come into play for those living in North Carolina who inherit money. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1206 million.

If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject for the federal estate tax with a progressive rate of up to 40. As the recipient of an inherited property youll benefit from a step-up tax basis meaning youll inherit the home at the fair market value on the date of inheritance and youll only be taxed on any gains between the time you inherit the home and when you sell it. In North Carolina you are not required to pay state estate tax or inheritance tax.

However state residents should remember to take into account the federal estate tax if. IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE. While North Carolinas estate tax was repealed in 2013 other taxes may apply to an inheritance.

Use this form for a decedent who died before 111999. North Carolina does not collect an inheritance tax or an estate tax. Even though estate taxes are the subject of much debate and many people dont like the idea of the estate tax estate taxes affected less than 14 of 1 018 if you are keeping score of all decedents in 2015.

Bank accounts certificates of deposit and investment. The inheritance tax rate in North Carolina is 16 percent at the most according to Nolo. Tax implications depend on the type of asset the value and other factors.

Surviving spouses are always exempt. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. When an heir is notified of their inheritance they should carefully review assets in light of their unique tax situation with a North Carolina tax lawyer.

However if you inherit an estate worth over 1118 million in standard assets such as bank accounts you may be required to pay taxes federal estate tax. A surviving spouse is the only person exempt from paying this tax. 28A-21-2a1 is not required for a decedent who died on or after 112013.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. There is no inheritance tax in North Carolina. Currently the law imposes a graduated Transfer Inheritance Tax ranging from 11 to 16 on the transfer of real and.

Put another way that means that you have a 998 chance of never having to worry about estate taxes. However there are sometimes taxes for other reasons. There is no inheritance tax in North Carolina.

Try it for free and have your custom legal documents ready in only a few minutes. NEW JERSEY TRANSFER INHERITANCE TAX - ESTATE TAX GENERAL New Jersey has had a Transfer Inheritance Tax since 1892 when a 5 tax was imposed on property transferred from a decedent to a beneficiary. You would receive 950000.

If you live in a state that does have an estate tax you may be expected to pay the death tax on the money you inherit from a death in NC. You might be interested. The estate would pay 50000 5 in estate taxes.

An estate tax certification under GS. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state. For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212.

Does North Carolina have an estate or inheritance tax. Items included in the deceased persons taxable estate include real estate vehicles and the proceeds from life insurance policies explains Nolo.

If You Need To Qualify For A Mortgage This Is Good News Chicago Real Estate Underwriting Mortgage

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog

North Carolina Estate Tax Everything You Need To Know Smartasset

Always A Great Feeling Getting Positive Feedback As Always Great Working With Great Clients Take A Look At My Zillow Real Estate News Positivity Feelings

How To Sell A House You Inherited In Miami The Reality Behind Probate Estate Lawyer Probate Estate Law

This Ad That S Starting To Get Desperate Funny Real Estate Ads Real Estate Tips Selling Real Estate

![]()

How To Sell My Inherited House In Greensboro North Carolina Greensboro North Carolina Things To Sell

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

How To Settle Sibling Disagreements And Make Better Decisions On Selling An Inherited Home Check This Out Inheritinghometips Sale House Home Selling House

What Happens When You Inherit A House Home Sellers Guide

How Do State Estate And Inheritance Taxes Work Tax Policy Center

1914 Kresge Mansion For Sale In Detroit Michigan Captivating Houses Mansions Abandoned Mansion For Sale Mansions For Sale

Mid Century Modern Homes For Sale Real Estate Mid Century Modern Home For Sale Indianapoli Mid Century Modern House Modern Homes For Sale Mid Century House

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

The Basics Of Nc Inheritance Laws Laskody Law Office Pc

Wholesale Opportunity In Reidsville Nc We Buy Houses Flipping Houses Home Buying